You might have heard the term Personal Savings Allowance but may not be quite sure what it means.

So, what is your Personal Savings Allowance?

In short, it’s the amount of interest you can earn before you need to start paying tax on your Savings as highlighted below:

- Basic rate (20%) taxpayers can earn £1,000 in tax-free interest.

- Higher rate (40%) taxpayers – £500 in tax-free interest.

- Additional rate (45%) taxpayers – £0.

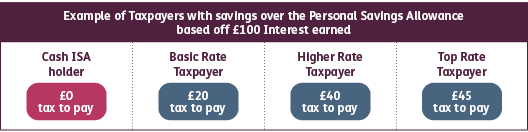

This example shows you how this might work in real terms:

Why is it important now?

The Personal Savings Allowance was introduced by the government in 2016 and since then savings interest rates have been relatively low.

However, in the last year, we've seen multiple Bank of England rate increases, and while this is exciting for Savers, you need to be aware that the additional interest you’re earning may take you above the Personal Savings Allowance threshold as shown above.

If the total interest earned is above your Personal Savings Allowance threshold and you are employed or receive a pension, HMRC may change your tax code and automatically collect any tax due. If you are self-employed, it is your responsibility to pay any tax through your annual self-assessment tax return.

If you’re unsure on the interest you have earned then your Bank or Building Society can help you with this.

Just remember though, the Personal Savings Allowance refers to the interest you earn on all of your Savings across different banks and building societies, so it could soon add up.

What about ISAs?

Good news – interest earned in an ISA doesn’t count towards your allowance. Even if the Personal Savings Allowance limits change, your ISA interest will still be protected. What’s more, if you move into a different tax band, or interest rates change, your ISA interest will remain tax-free.

If you think you might be reaching your Personal Savings Allowance limit, or just want to check if you could earn a higher rate of interest, please have a look at our savings accounts to see if they could be right for you.

Starting rate for savers

It’s also worth noting that if your income is less than £17,570 you may also earn up to £5,000 of interest without having to pay tax on it. This is your starting rate for savings. Every £1 of other income above your Personal Allowance reduces your starting rate for savings by £1.

To find out more about tax-free interest on your savings, you can visit gov.uk.

Tax treatment depends on the individual circumstances of each customer and may be subject to change in future.

Share this article

Related news

Savings

17 Dec 2025

Smart saving: how to enjoy Christmas without overspending

Louise Halliwell

17 Dec 2025

Smart saving: how to enjoy Christmas without overspending

Louise Halliwell

As the festive season approaches, many feel pressure to create the “perfect” Christmas.

Read more

Savings

09 Dec 2025

Cash ISA news

Product Team

09 Dec 2025

Cash ISA news

Product Team

After the Autumn budget announcement by the Chancellor, Rachel Reeves, we explore the key changes to the ISA allowance and how it will affect you and your savings.

Read more